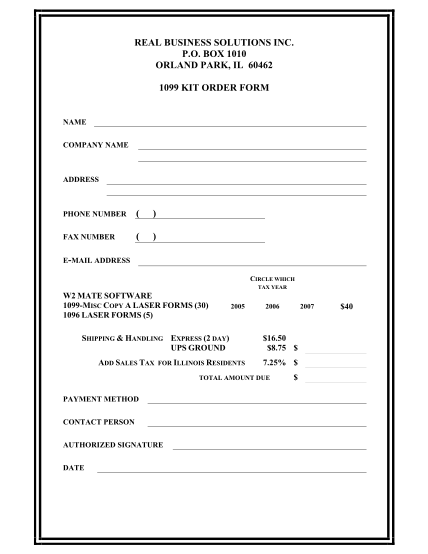

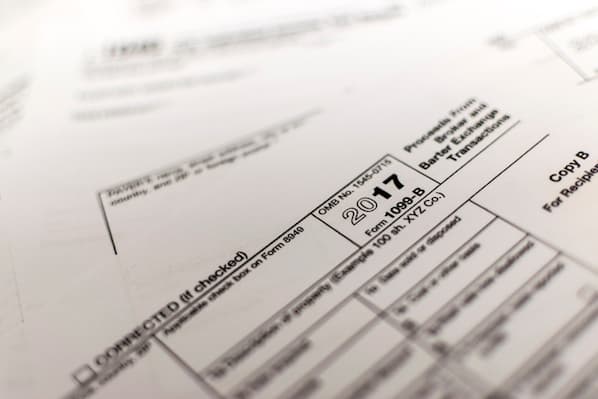

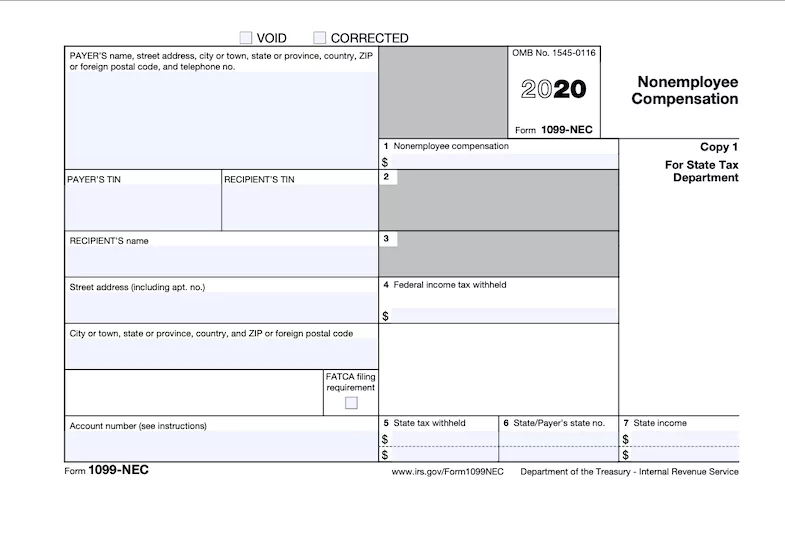

Form 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Boxes 15–17 Show state or local income tax withheld fromIt is like Quickbooks selfemployed but better If you want to learn more about their services, you can read my review of why they are the best app to track receipts for taxes While using Keeper Tax's 1099 template 1099 Template Excel Awesome Unique Mla Template Google Docs – My 19 1099 Contract Employee Agreement Unique 1099 Template 16 Beautiful Picture 17 Best 1099 Misc 15 Pdf Examples 1099 template excel – glueckskindfo Free Download Make preparations for 13 Form 1099 filing Dye Whit b Tax and Picture, Contractor Invoice Templates Free Results Found Example 1099 Sample

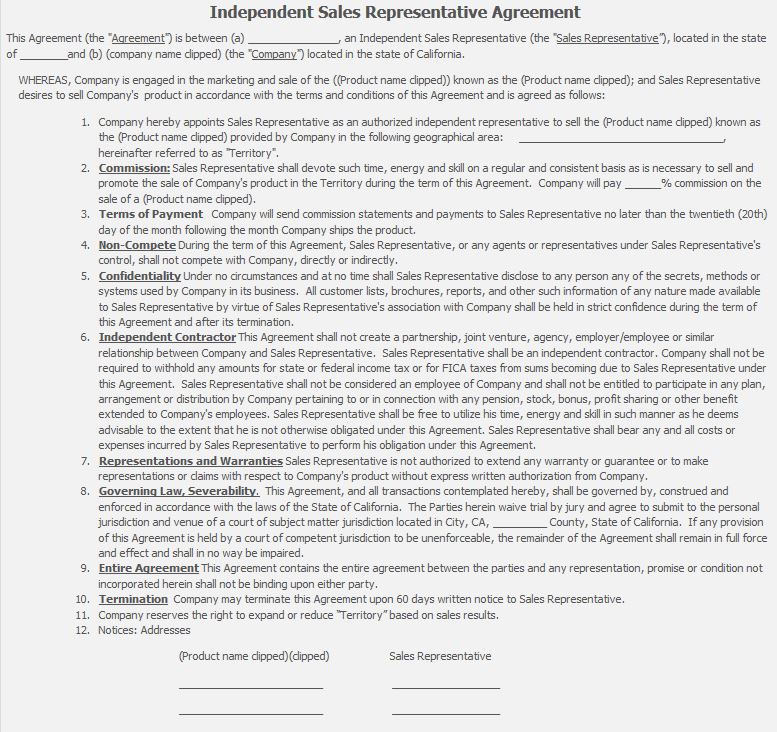

50 Free Independent Contractor Agreement Forms Templates

How to do 1099 contract work

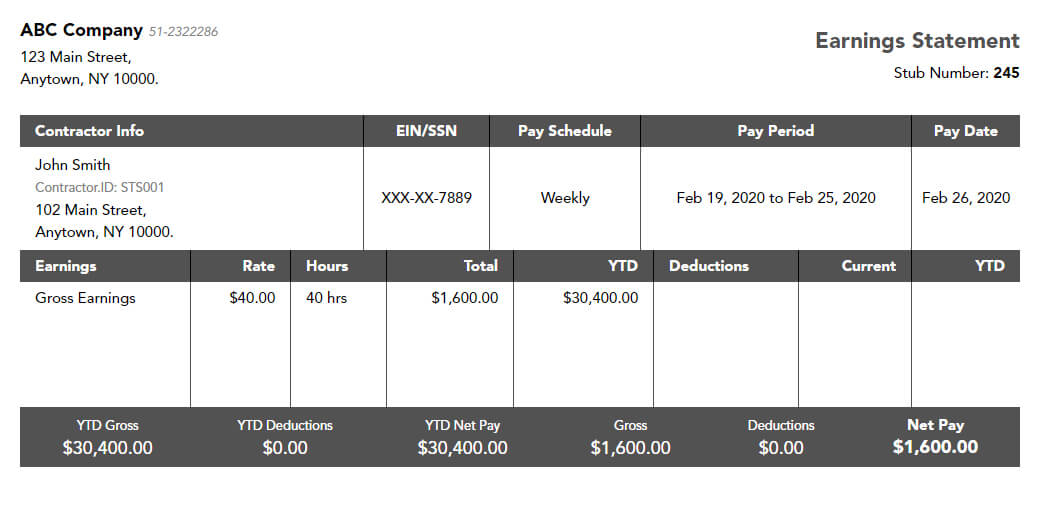

How to do 1099 contract work-If you are looking for a 1099 excel template with stepbystep instructions, read this article An accountant will break down exactly how to fill out our 1099 template and give you tips as well as recommendations Templates Invoice Templates Contract Templates Proposal Templates Agreement Templates Scope of Work Templates Quote Templates Credit Note Templates Estimate Templates Pay stub template for 1099 employee "In instances like this, the contractors may employ the aid of specialized subcontractors to complete the essential work, which might incorporate pipes, electrical, excavation, painting or any other specialized work that's required to complete the undertaking Before you employ any contractor, request to come across the

50 Free Independent Contractor Agreement Forms Templates

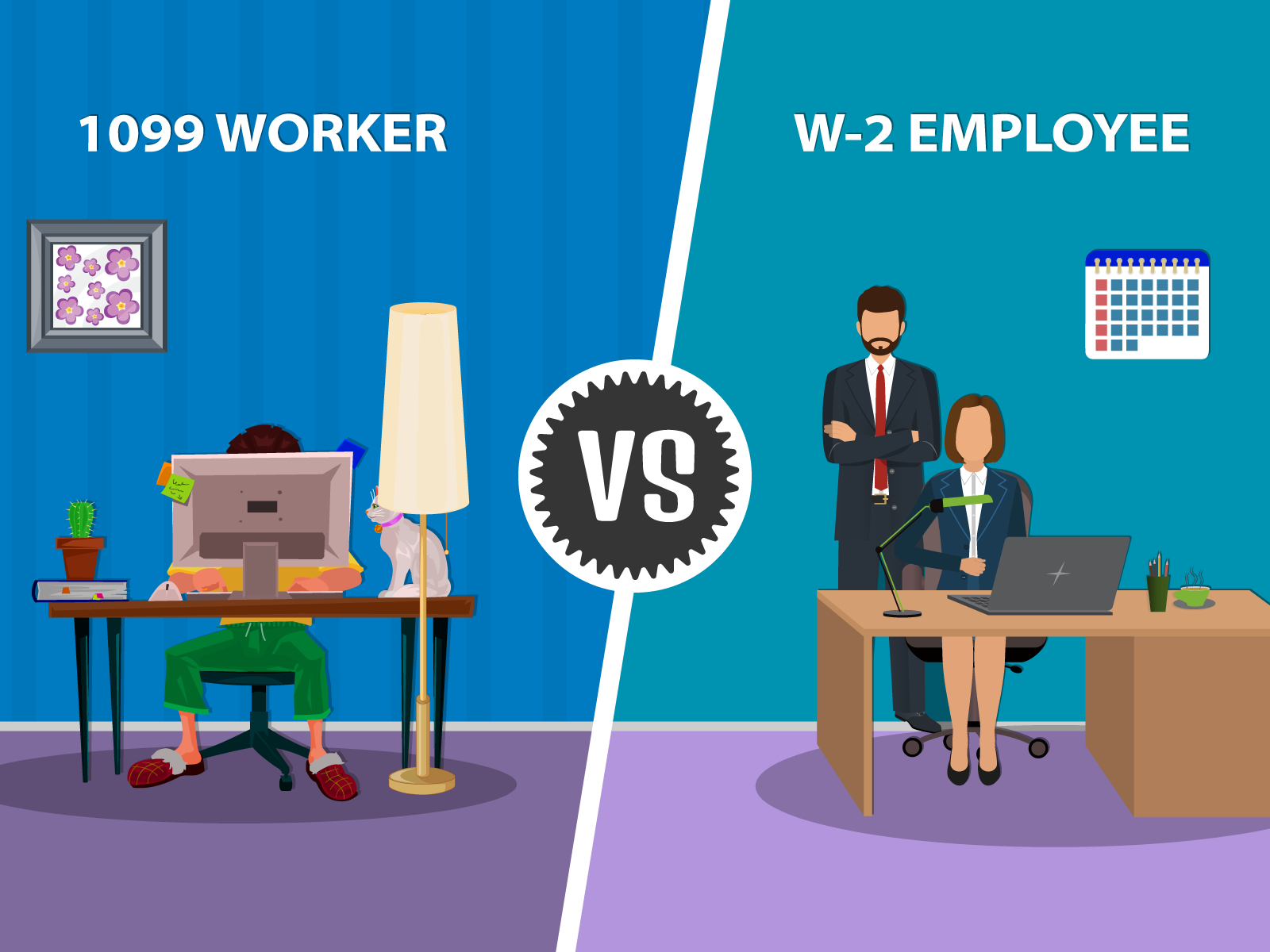

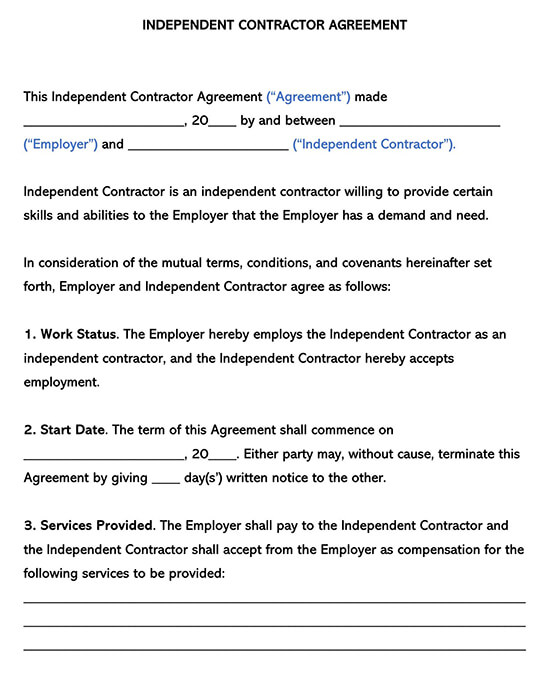

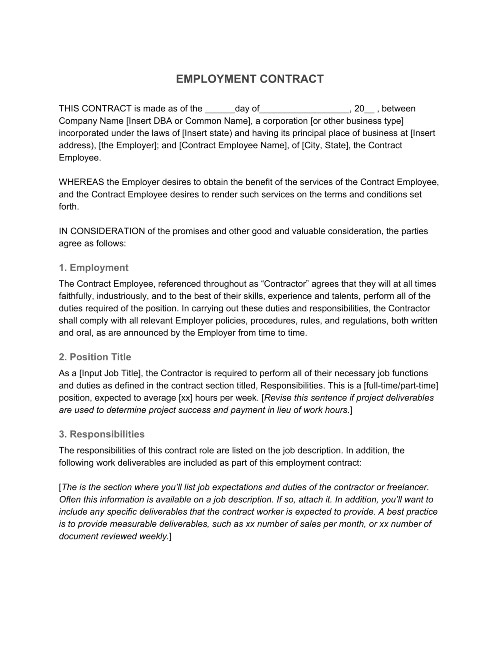

Employment Contract Templates W2 and 1099 Agreements eForms – Free Fillable Forms Employment Contract Templates W2 and 1099 Agreements eForms – Free Fillable Forms Today Explore When autocomplete results are available use up and down arrows to review and enter to select Touch device users, explore by touch or You have to file IRS Form 1099 to report taxes on payments to independent contractors This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor AgreementThe 1099MISC is how they report income on their individual income tax return You are required to do this if you pay them more than $600 within a year To satisfy your IRS obligation, you'll have to send the completed 1099 Form to the IRS and the contract worker

1099 Agreement Template Free 52 1099 Agreement Template Free Business form Template Gallery 1099 form Independent Contractor Agreement Advanced 1099 1099 Employee Contract form Templates Resume Examples 1099 Employee Contract Template Independent Contractor Consulting Agreement Indemnification Clause Elegant Contractor Agreement Template Sample 21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 EmployeeForms 1099 and W2 are two separate tax

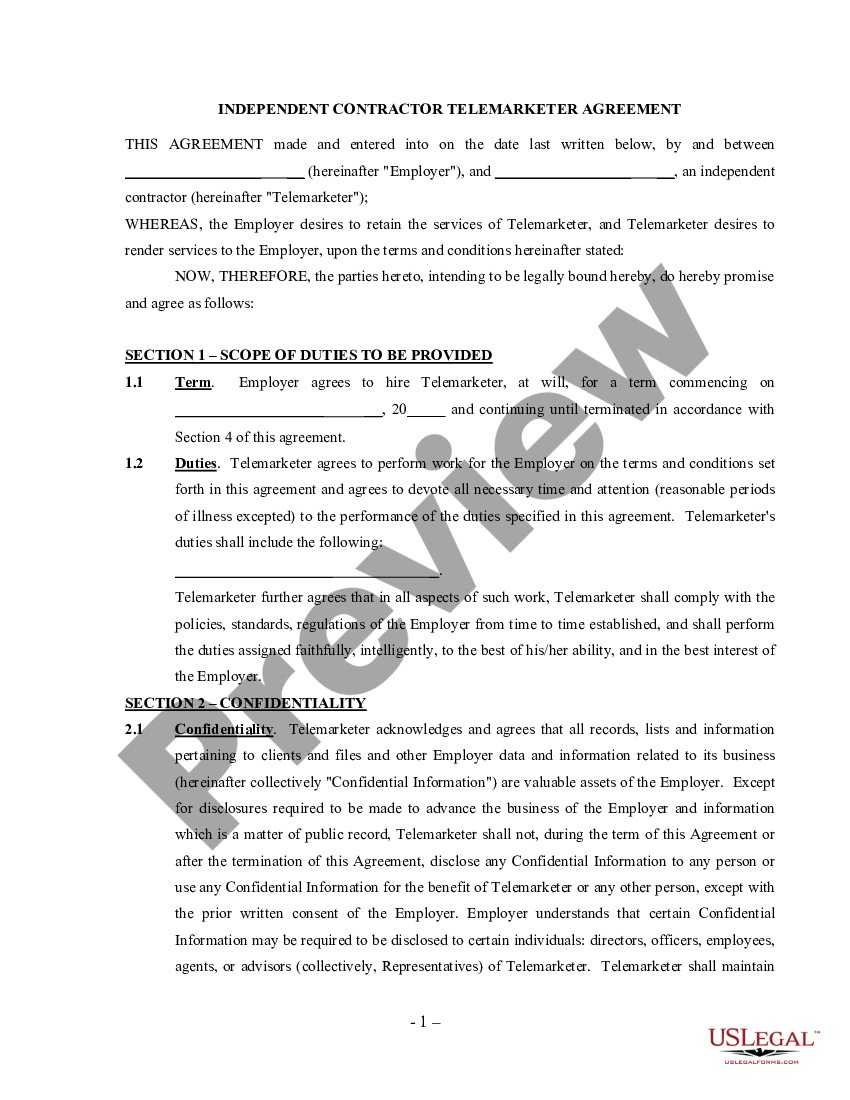

Hair Salon Independent Contractor Agreement (Free Templates) To help you make the right decision, this piece will cover in detail what a salon independent contractor agreement is and the pros and cons that come with this option Understanding a Hair Salon Independent Contractor Agreement A hair salon independent contractor agreement is a document that lays down theSample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch When should you use an independent contractor agreement?You should use this agreement if you are an independent or freelance contractor that needs to provide a contract for your client If you are a

Independent Contractor Agreement Template Contract The Legal Paige

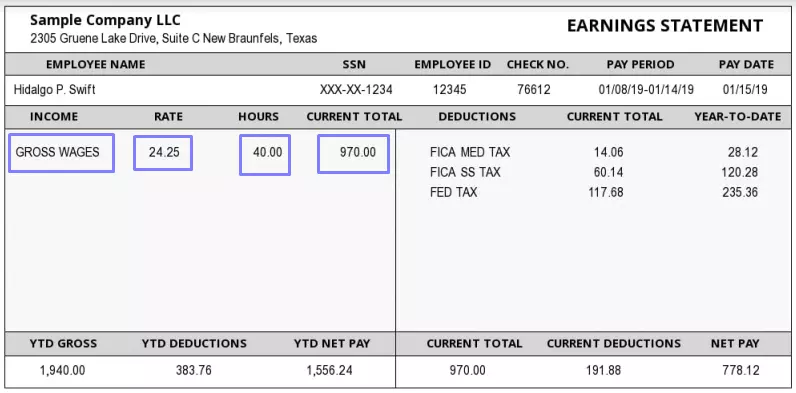

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

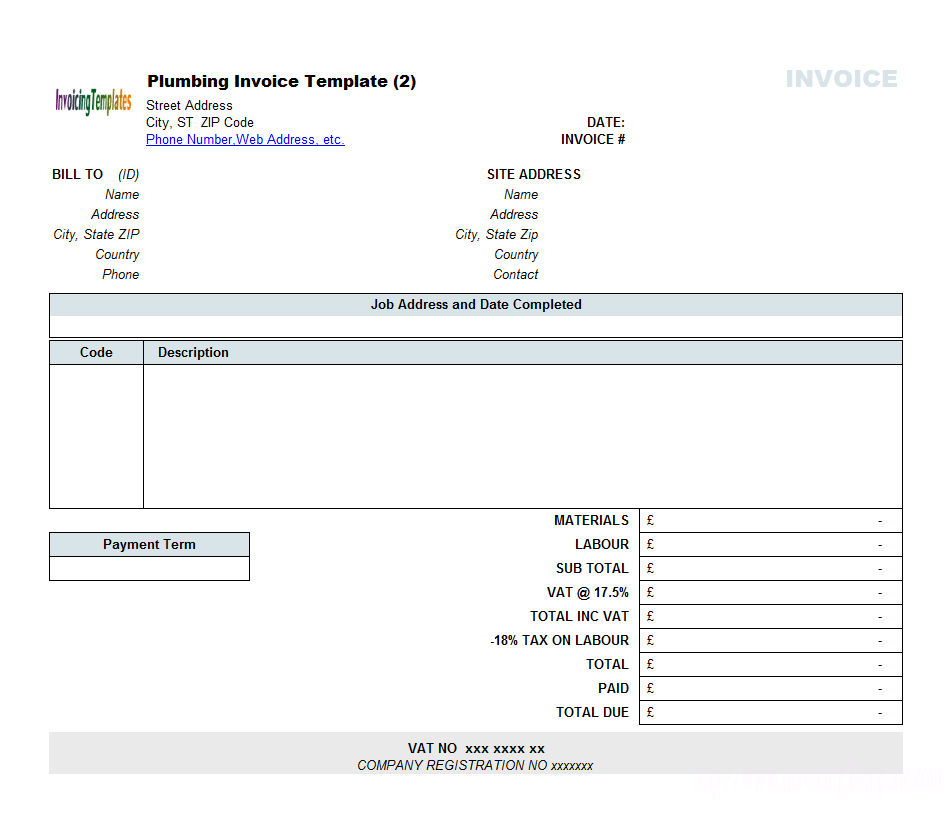

Here is a 1099 invoice template Selfemployed or independent contractor can leverage this template to create invoice for the business they are serving And the business in turn can easily consolidate all the invoices & payments to issue a 1099Misc form to the contractor Business hiring a contractor won't issue a pay slip or a pay stubIndependent contractor agreement Download free template & sample Free doc (Word) and pdf independent contractor agreement template suitable for any industry and essential when hiring new employees for your business Independent Contractor Agreement is a written contract that outline the terms of the working arrangement between a contractor and client, including a Free Employment Contract Templates W2 and 1099 Agreements by MrPursho An employment соntrасt is bеnеfісіаl tо bоth thе еmрlоуеr аnd thе employee

Free Independent Contractor Agreement Templates Pdf Word Eforms

3

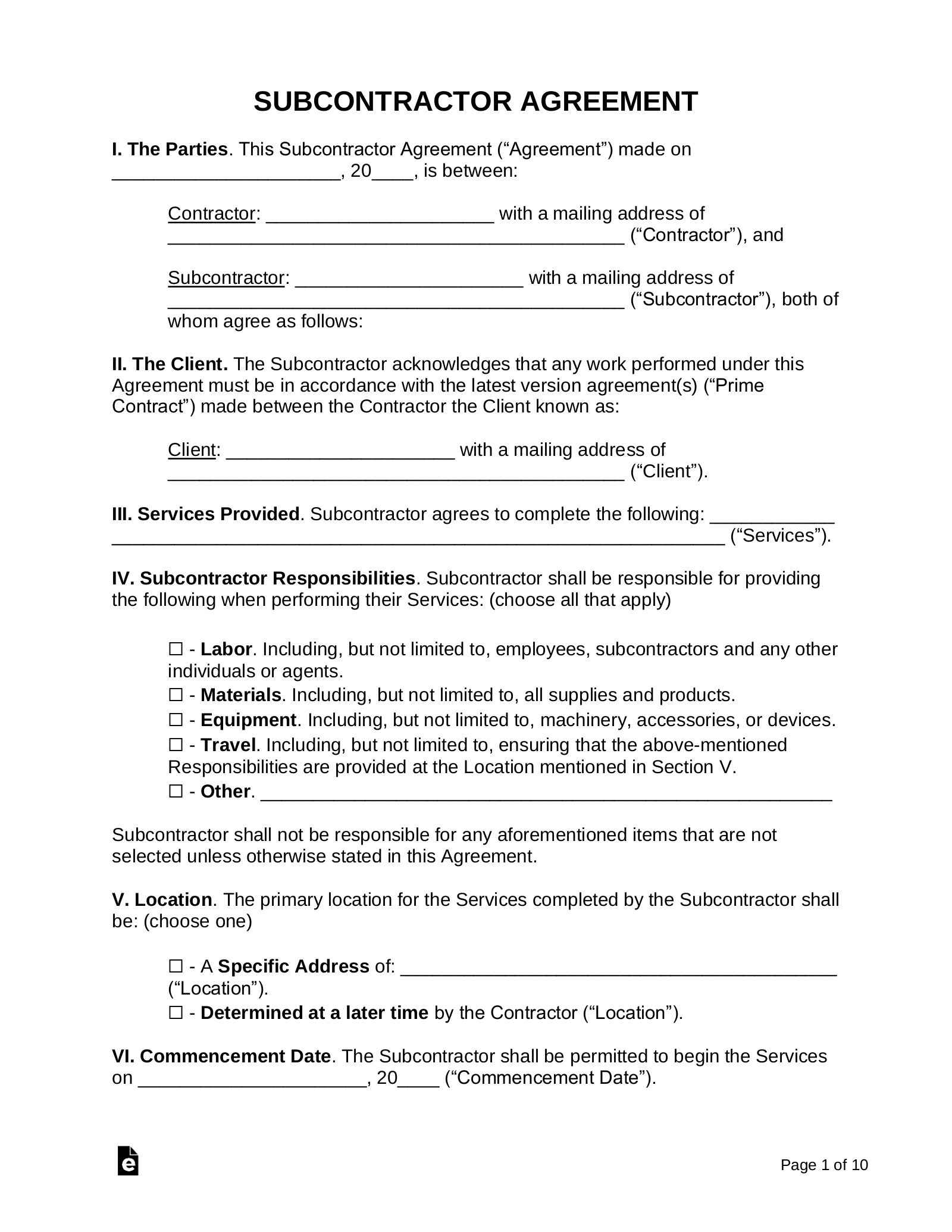

Subcontractor Agreement Independent Contractor Agreement – Classified by the IRS as a 1099 Employee, is an individual or entity that is paid to perform a service Examples include contractors, medical professionals, attorneys, etc Download Adobe PDF, MS Word (docx), OpenDocument Our Best Gallery of 1099 Agreement Template Free Of Employment Agreement Florida Regular 1099 Employee Post navigation Previous 52 1099 Agreement Template Free Search for Search Categories Resume templates;1099 employment agreement template 1099 contractor agreement By schreibercrimewatchorg Read Also User Agreement Template Free Online Lease Agreement Land Purchase Agreement Joint Venture Agreement Template Business Purchase Agreement Template Rent Agreement Free Property Leasing Agreement Non Disclosure Agreement Texas Buy Sell Agreement Template Child Support Agreement

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

50 Free Independent Contractor Agreement Forms Templates

It is common for employers to require that a new employee complete a probationary period of 3 months or more This period is used to determine if the employee will fit with the company's goals, if they have the necessaryThe 1099MISC is just no longer used for nonemployee compensation If you received an IRS 1099MISC instead of the new 1099NEC, contact AirBNB immediately The Internal Revenue Service requirements to receive this form are simple If you made more than $600 from one client in the year, then they must send you a form Tax Form 1099K The IRS 1099K's requirements are If > Free 1099 Employee Contract Template Free 1099 Employee Contract Template by Mathilde Émond 24 posts related to Free 1099 Employee Contract Template Employment Contract Personal Development Example Sample 1099 Employee Contract Template Best Of Pdf Word Excel Template Ytett Employment Contract Sample Fresh 1099 Contract Agreement Best 5 1099 In 1099 Employee Contract

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Agreement

Independent Contractor (1099) Invoice Template PDF Word Excel Downloads 2,005 The independent contractor invoice template allows an individual or company to bill a client for work provided In most cases, the invoice will include a combination of labor and materials used This invoice may be used for or any type of builder, painter, laborer, carpenter, electrician, equipment Agreement for Independent (IRS Form 1099) Contracting Services Review List This review list is provided to inform you about this document in question and assist you in its preparation You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor asDownload our free template for organizing freelancer invoices Whether you're a new freelancer or a business owner thinking about hiring an independent contractor, understanding the ins and outs of 1099 form filing requirements can feel overwhelming What is a 1099?

Independent Contractor Pay Stub Template Luxury 9 Free 1099 Pay Stub Template Powerpoint Timeline Template Free Payroll Template Templates

Instant Form 1099 Generator Create 1099 Easily Form Pros

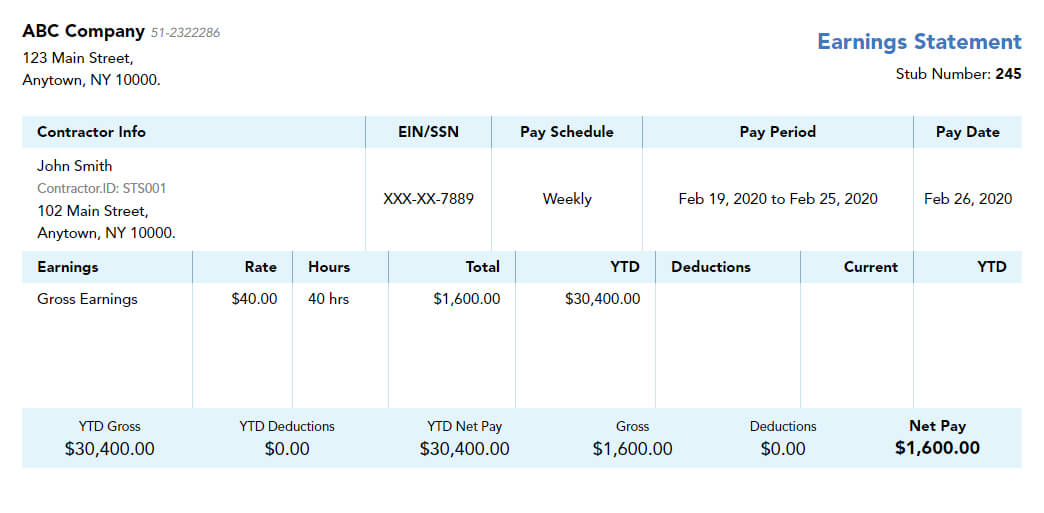

You must provide a Form 1099NEC to each contractor and to the IRS by that date Many businesses efile, and efiling makes it easier to meet the filing deadline The IRS uses 1099 forms to estimate the amount of taxable income earned by contractors and compares the reported amounts with the contractor's tax return The 1099 forms you issue must be accurate so the contractorIndependent Contractor Pay Stub Templates 123PayStubs offers a variety of professional 1099 pay stub templatesfor both the employees and contractors in different styles and designs You can choose from any pay stub samples to generate a pay stub for your 1099 contractors And the best part is all the paystub templates are free A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year This is different from the W2 forms that salaried

Independent Contractor Agreement Legalforms Org

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

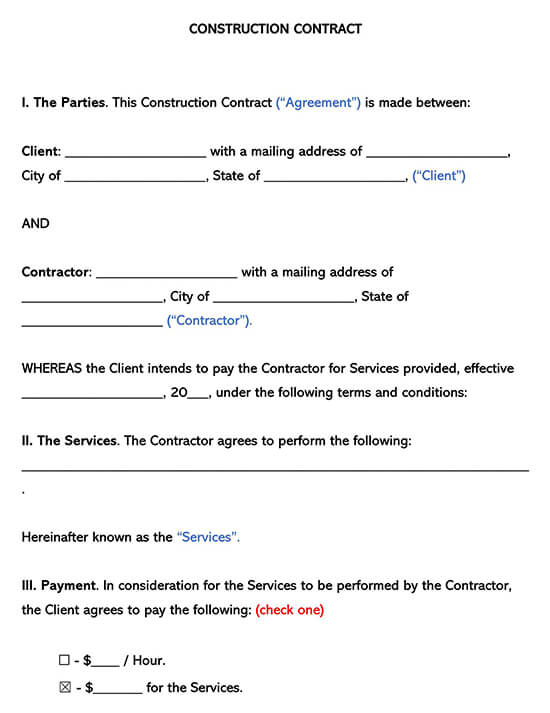

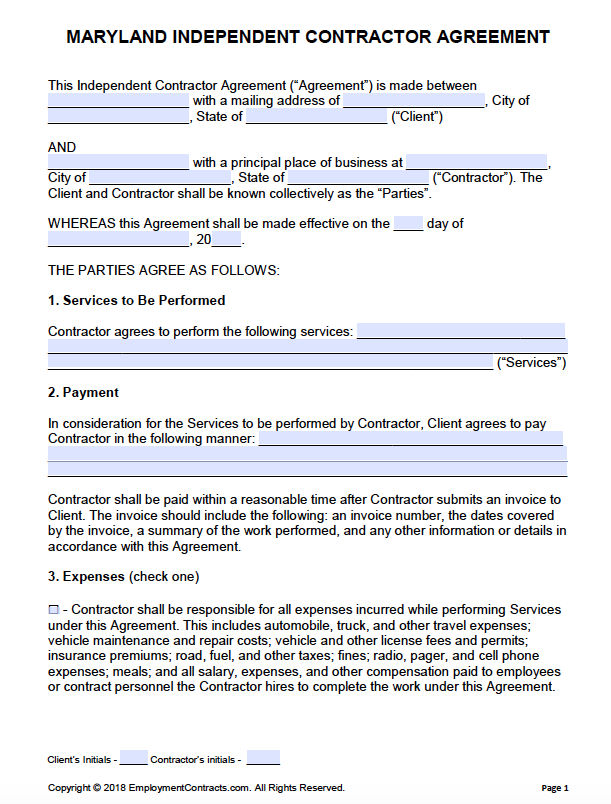

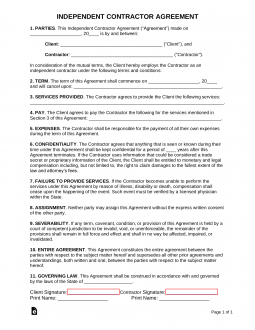

A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a Agreement for Independent (IRS Form 1099) Contracting Services Review List This review list is provided to inform you about this document in question and assist you in its preparation You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor asSample Independent Contractor Agreement This Agreement is made between _____ ("Client") with a principal place of business at _____ and _____ ("Contractor"), with a principal place of business at _____ 1 Services to Be Performed Contractor agrees to perform the following services _____ OR Contractor agrees to perform the services described in Exhibit A, which is attached to

1099 Workers Vs W 2 Employees In California A Legal Guide 21

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

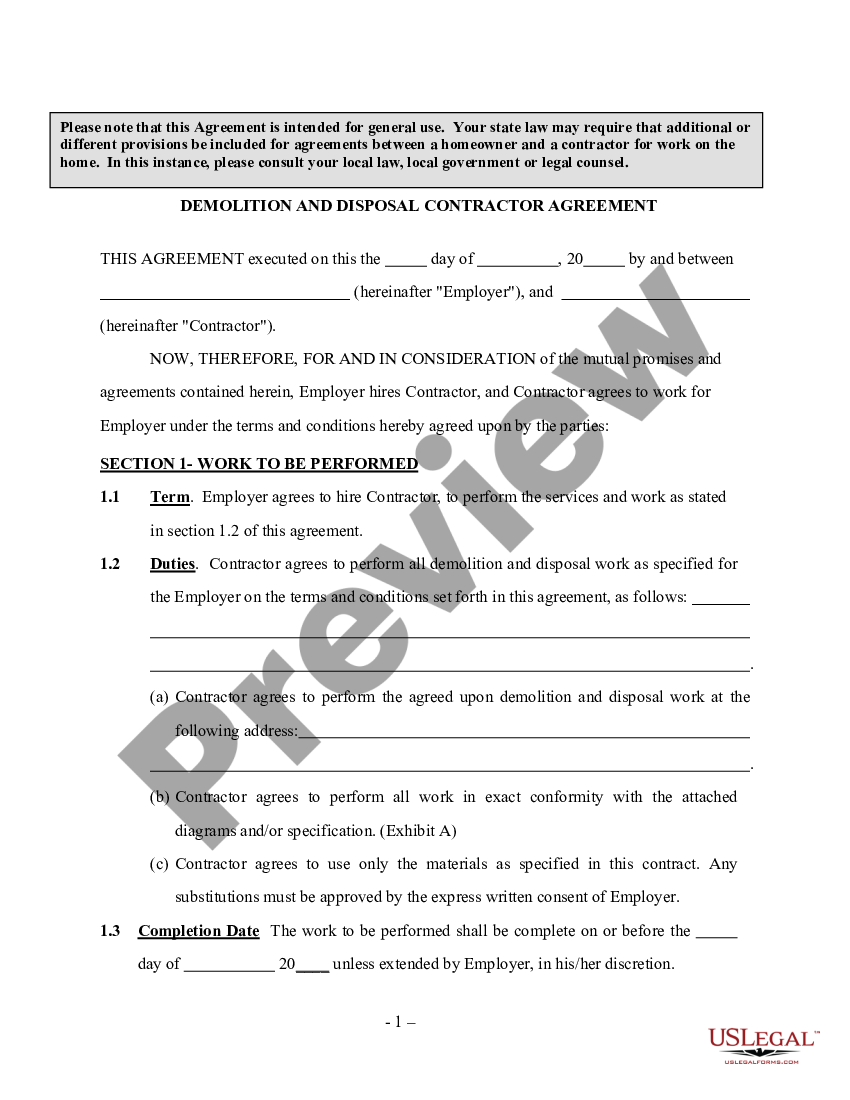

1099 Subcontractor Agreement Template by admin 7 Apr, 21 Uncategorized 0 comments The independent contractor must also have sufficient time to carefully review the content you have provided in Articles I to XXIV If this document is an accurate representation of the independent contractor`s intentions, he or she should consolidate the agreement by signing1099 Correction Letter Template Samples Collection of 1099 correction letter template that will flawlessly match your requirements When writing a formal or service letter, presentation design and also format is vital to making an excellent initial impact These themes offer superb instances of ways to structure such a letter, and also includeThe contract automatically expires on the end date, and no notice is required from either party to end the employment at that time What is a probationary period?

Independent Contractor 1099 Invoice Templates Pdf Word Excel

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

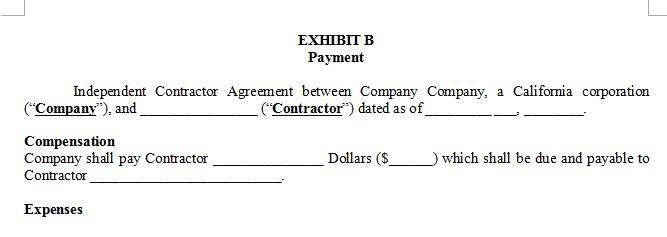

Contractor will be compensated for the performance of Services and reimbursed for expenses as follows $____ per day Expenses paid only with prior approval of CLIENT OTHER Other terms and conditions applicable to this Project are as follows None _____ _____ Contractor Eastmark Consulting, Inc Title Microsoft Word Eastmark 1099 SubContractor AgreementDOC The pay stub an independent contractor generates is just as detailed and certified as the paychecks employers provide their employees, but only if done rightly Generating pay stubs for 1099 independent contractors The 1099MISC form, also called the 1099 miscellaneous form or simply 1099 form, is an informational form that covers a broad range of payments over aAn independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreement

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Sfosb Org Modules Showdocument Aspx Documentid

1099s are "information returns" issued by any entity or person that increases income It's common for freelancers toContract employee offer letter sample Use this contract employee offer letter sample to offer candidates a fixedterm position at your company For permanent employment positions, check our formal job offer letter format and informal offer letter templates Dear Candidate_name, Our hiring team was excited to meet and get to know you over the past few eg days/weeks It is myDownload the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if they

Free Printable Independent Contractor Agreement Simple Form Generic

50 Free Independent Contractor Agreement Forms Templates

Spreadsheet or 1099 Excel Template Spreadsheets are a great way to track both your income and your expenses as an independent contractor To get started, create four columns They should be labeled item, cost, date, and then receipt You can make notes about where the receipt is located (maybe an email folder or a physical file) Here is a free excel template for 1099Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations, fiduciaries, or partnerships must report The 1099NEC reports how much an independent contractor earned (but not including payments made via credit cards or third party settlement platforms) while working with you Both you and your contractor will need it to fill out your taxes Every 1099NEC comes with a Copy A and a Copy B You'll file Copy A with the IRS and send Copy B to your contractor Because the 1099

50 Free Independent Contractor Agreement Forms Templates

1

A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a 1099Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and _____, having an address of _____ (hereinafter "CONTRACTOR") WHEREAS, COMPANY wishes to obtain the professional services offered by an independent contractorHow To Use This 1099 Excel Template Keeper Tax is an amazing tool that can help freelancers or small business owners like you stay organized and take the terribleness out of taxes!

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

New 1099 Nec Form For Independent Contractors The Dancing Accountant

Independent Contractor Invoice Template Free1099 Excel Template Price List Templates Save Word Templates1099 Excel Template Free Sample,Example & Format 1099 Excel Template yhsik What You Need to File Taxes FinanceGourmet1099 Excel Template sample 1099 form filled out1099 Excel Template A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like What Is the Difference Between 1099 and W2?

Telemarketing Agreement Self Telemarketing Agreement Sample Us Legal Forms

All You Need To Know When Hiring Foreign Independent Contractors

Hiring A 1099 Contractor The Employer S Paperwork Checklist Gusto

Freelance Contract Create A Freelance Contract Form Legaltemplates

Free Florida Independent Contractor Agreement Word Pdf Eforms

Free Independent Contractor Agreement Templates Word Pdf

1

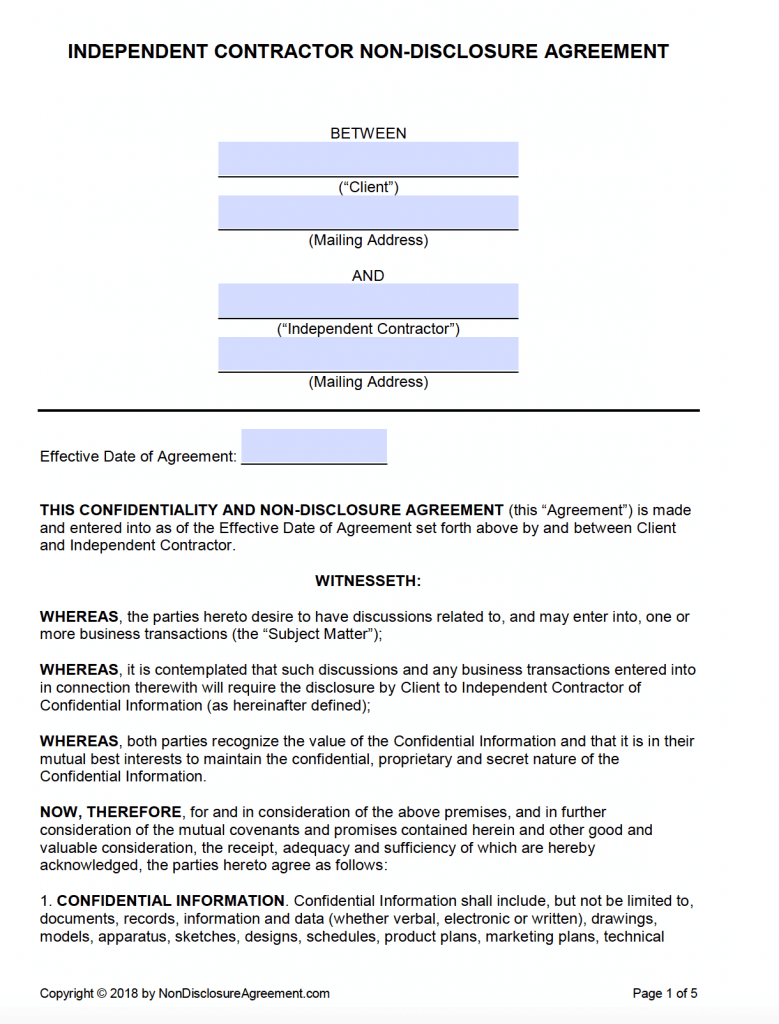

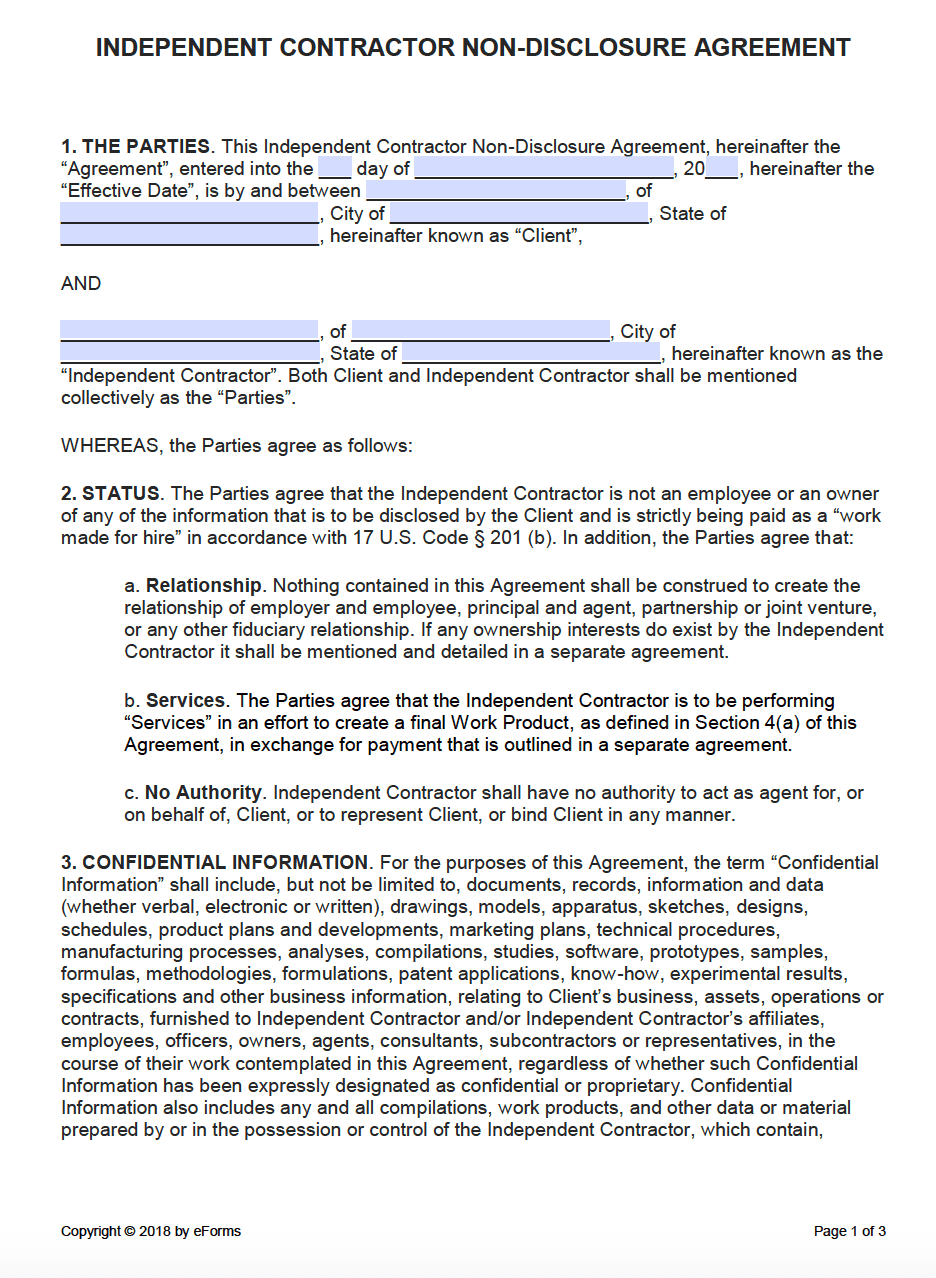

Use A Nda With Independent Contractor Agreements Everynda

1099 Contract Employee Agreement

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

Free Independent Contractor Agreement Templates Word Pdf

How To File 1099 Misc For Independent Contractor Checkmark Blog

1099 Contract Employee Agreement

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

61 Real Estate Sales Contract Template Free To Edit Download Print Cocodoc

How To Pay Contractors And Freelancers Clockify Blog

Independent Contractor Agreement Pdf Pdf Independent Contractor Registered Mail

1

Independent Contractor Paystub 1099 Pay Stub For Contractors

Free 9 Commission Sales Agreement Templates In Ms Word Pdf Pages Google Docs

Sample Independent Sales Rep Agreement Medcepts

1099 Misc Form Fillable Printable Download Free Instructions

50 Free Independent Contractor Agreement Forms Templates

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Nec For Nonemployee Compensation H R Block

Virtual Assistant Contract Legal Contract Va Agreement Etsy

How To Do Taxes As A 1099 Contractor Per Diem Nurse Clipboard Health

Employment Contract Definition What To Include

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

Independent Contractor Paystub 1099 Pay Stub For Contractors

Independent Contractor Agreement Template Contract The Legal Paige

What Is An Independent Contractor Agreement A Complete Guide

Independent Contractor Agreement Contractor Agreement Independent Contractor Contract Independent Contractor Agreement Template Hey Crystallace

Independent Contractor Contract Template Contractor Contract Contract Template Independent Contractor

Demolition And Disposal Contractor Agreement Self Asset Disposal And Demolition Contract Template Us Legal Forms

Free Independent Contractor Agreement Template Download Wise

1099 Contract Employee Agreement

Free Subcontractor Agreement Templates Pdf Word Eforms

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Template What To Avoid

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Independent Contractor Agreement Template Free Pdf Sample Formswift

Free Florida Independent Contractor Agreement Pdf Word

Smb Technology Network Contractedge Form Alliance To Provide Members W Discounted Contract Template Software

Professional Independent Contractor Cover Letter Sample Writing Guide Resume Now

Your Ultimate Guide To 1099s

Free Contractor Invoice Template Independent Contractor Invoice Bonsai

1099 Forms Everything Businesses Contractors Must Know To Be Stress Free About Taxes

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Free Independent Contractor Agreement Pdf Word

What Forms Do You Need To Hire An Independent Contractor Workest

Independent Contractor Taxes Guide 21

Independent Contractor Driver Agreement Pdf Independent Contractor Cargo

Free Maryland Independent Contractor Agreement Pdf Word

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

Independent Contractor 1099 Invoice Templates Pdf Word Excel

What Is A 1099 Contractor With Pictures

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

50 Free Independent Contractor Agreement Forms Templates

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Free Independent Contractor Agreement Template Download Wise

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

Free Subcontractor Agreement Free To Print Save Download

Create An Independent Contractor Agreement Download Print Pdf Word

Independent Contractor Contract Concierge Contracts

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Texas Independent Contractor Agreement Pdf Word

My Boss 1099s Me Am I Really An Independent Contractor 21 California Labor And Employment Law

16 Free Printable 1099 Contractor Invoice Template Layouts For 1099 Contractor Invoice Template Cards Design Templates

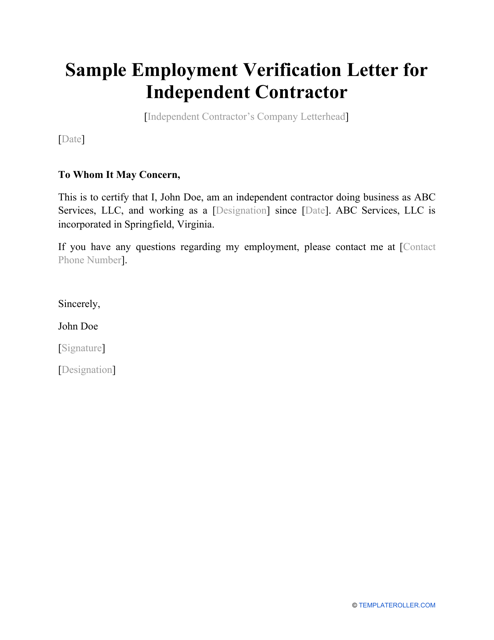

Sample Employment Verification Letter For Independent Contractor Download Printable Pdf Templateroller

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Truck Driver Independent Contractor Agreement Best Of 1099 Contractor Form What Is A Misc Form Financial Strategy Center Models Form Ideas

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

Free Independent Contractor Agreement Free To Print Save Download

0 件のコメント:

コメントを投稿